Y VENTURES

INVESTMENT BANKING FOR GAME CHANGERS

WHAT WE DO

Y VENTURES is an independent investment bank dedicated to growth companies and tech-enabled businesses across Europe.

We provide non-conflicted advice and first-class execution capabilities to exceptional entrepreneurs at key stages of their development.

With over 60 transactions successfully managed since 2018, we have developed a strong expertise in verticals such as B2B Software & Platforms, Retail and E-Commerce, Real Estate, Healthcare Services, Fast Moving Consumer Goods (FMCG) & Fast-growing Hardware & Manufacturing players.

We focus on transactions with a valuation range from €20m to €500m.

Main areas of expertise include:

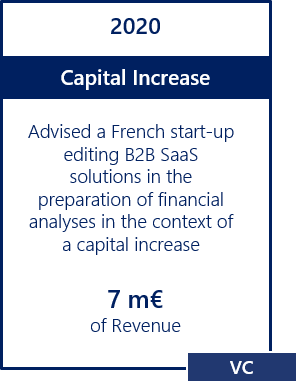

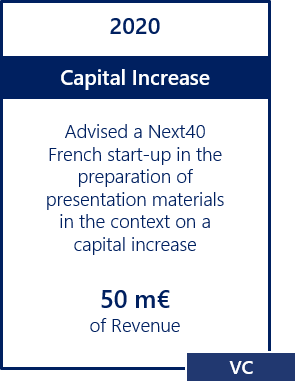

- Capital Increase - growth, capital development

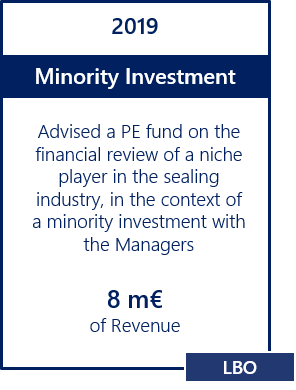

- LBO / Build-up financing

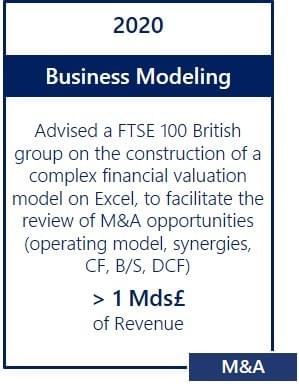

- M&A advisory

- In & Out-of-court debt restructuring

- Other strategic matters - shareholder & management advisory

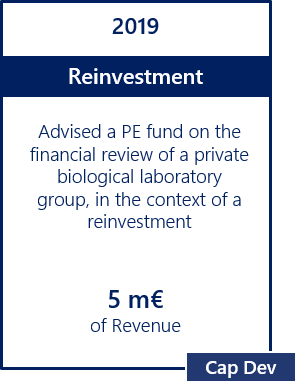

TRACK RECORD

70+ transactions successfully managed since 2017

both for:

- Management and Shareholders (c. 40 projects)

- Investors and Buyers (c. 30 projects)

Below is a selection of recent projects conducted by our team members:

WHO WE ARE

Yannick

HENRIOTPartner

Yannick is a corporate finance professional with more than 10 years of experience gained in large corporates (Air Liquide, Sanofi), financial advisory firms (PwC, M&A boutique) and tech startups, in general management roles, both in Paris and Berlin.

He studied at ESCP Business School and University of Illinois (USA).

William

RISCHMANNPartner

William has 20 years of experience in corporate finance as an advisor (PwC TS, M&A boutiques), CFO or investor. He worked on 100+ transactions (M&A, LBO, A/B Series,) for both corporates and PE funds. He recently developed a track-record in rapidly growing tech-enabled businesses. William also runs entrepreneurship projects.

He graduated from Toulouse Business School.

Thomas

NAGARD

Associate

Thomas has more than five years of experience in financial advisory (Impulse Corporate Finance, Innovafonds, Mazars), he developed expertise in tech-enabled businesses.

He studied at ESTP and EDHEC Business School.

Amélie

Valentin

Senior Analyst

Amélie has more than three years of experience in financial advisory (Mazars, Chausson Finance), especially in tech M&A.

She graduated from EM Lyon Business School.

Martin

AUMONIER

Senior Analyst

Martin has more than two years of experience in financial advisory (YV, Cambon Partners), especially in tech M&A.

He graduated from ESSEC Business School.

Grégoire

ROBIN

Analyst

Grégoire joined Y Ventures in 2024 as an Analyst. He has previous experiences in M&A with Linkers and ValiEnte Invest.

He graduated from ESCP Business School and Rotterdam School of Management (Netherlands).

Lavanya

NAYAR

Analyst

Lavanya joined Y Ventures in 2025 as an Analyst. She has a previous experience in Private Equity with Ardian.

She graduated from UCL (UK) and University of Amsterdam.

Guillaume

MENUET

Analyst

Guillaume joined Y Ventures in 2025 as an Analyst. He has previous experiences in Financial Management and Investment, with Lactalis and Renaissance.

He graduated from ESSCA and University of Paris-Assas.

Jean

TRICHET

Analyst

Jean joined Y Ventures in 2025 as an Analyst. He has a previous experience in Venture Capital with Crédit Mutuel Equity.

He studied at ESCP Business School.

RESEARCH & PUBLICATIONS

JUNE 2025 | FRENCH SOFTWARE MARKET M&A AND FUNDRAISING OVERVIEW SINCE 2022

Overview:

- French software M&A remained resilient from 2022–2024, with a slight drop in exits but signs of rebound in early 2025.

- Mid-sized targets (€10–100m revenue) gained traction, rising from 5 exits in 2023 to 14 in 2024.

- Strategic buyers slowed activity due to rising financing costs, while financial sponsors remained active.

- Fundraising volumes declined, but total deal value grew from €3.9bn (2023) to €5.4bn (2024), favoring quality over quantity.

- Enterprise Software, Big Data/AI, and FinTech led both exits and fundraising, attracting 69% of total capital.

- ARR multiples on fundraisings increased from 7.9x (2022) to 8.8x (2025 Q1), with small high-growth firms commanding top valuations.

ACCESS THE STUDY

Name *Email *Enter your professional email addressCompany *MAY 2025 | RISE OF TECH PUBLIC-TO-PRIVATE DEALS SINCE 2021

Overview:

- Since 2021, Tech public-to-private (P2P) deals have surged globally, with 2024 marking a record 63 transactions totaling €91bn.

- Europe led the value growth (x12 since 2021), driven by strong private equity interest.

- Valuation gaps between public and private markets, unprofitable company profiles, and poor stock performance fueled this trend.

- Premiums offered by sponsors rose to offset low public valuations, averaging 43% from 2020–2024.

- Top U.S. funds like Thoma Bravo and Vista Equity dominated, with 56% of deal activity.

- The momentum continued into early 2025, supported by high PE dry powder and recent IPO underperformance.

ACCESS THE STUDY

Name *Email *Enter your professional email addressCompany *WHEN TO CALL Y VENTURES?

- We have a broad and successful experience collaborating with a diverse range of French and European startups, scale-ups, and SMEs, across a valuation spectrum ranging from €20 millions to €500 millions.

- Our primary role often involves working closely with Management or Shareholders to help them achieve their strategic goals, whether it's securing equity or debt funding for organic growth or strategic build-ups, facilitating business exits, or navigating out-of-court debt restructuring through conciliation or mandat ad hoc.

- We are also experienced in helping PE houses or strategic buyers at different stages of their investment/acquisition project. Our responsibilities may encompass conducting preliminary financial assessments of potential targets and help structure a preliminary offer (LOI), or guiding the entire process (M&A mandates). Our experience spans both healthy (in bonis) and distressed targets.

ESTABLISHED NETWORK OF PARTNERS

- We collaborate with a well-established network of dependable professionals, including corporate and restructuring lawyers, transaction services advisors, accountants, private investors, and industry-specialized senior advisors. This network spans across Paris and Europe, enabling us to mobilize the right expertise whenever our clients require it.

Y VENTURES Paris Office

Y VENTURES

75, Boulevard Haussmann

Paris 75008 - France

T+33 (0)1 89 16 07 47

Applications are welcome at careers@yventures.eu

© 2019 - Y VENTURES S.A.S.

N°SIREN 847 547 072 – R.C.S. Paris